- Price: $2,633.98

- Market cap: $317 billion

Ethereum is a form of digital currency, or cryptocurrency, that exists solely online and serves as a medium of exchange. It is one of the most popular cryptocurrencies globally, ranking second in size as of May 2024, behind Bitcoin, the best-known digital currency. While cryptocurrencies have generated much excitement as the potential future of payment systems, they have also faced criticism, with some dismissing them as speculative bubbles. Here’s an overview of what Ethereum is and how it operates.

What is Ethereum?

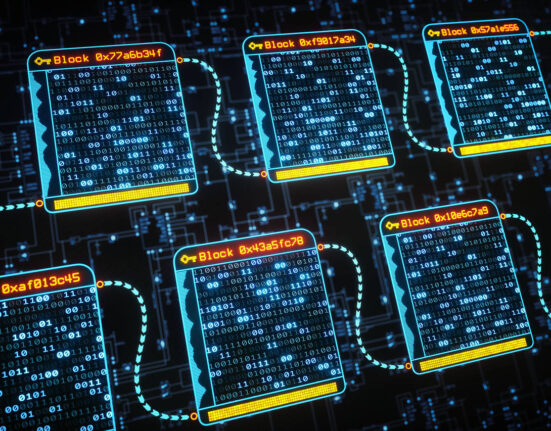

Ethereum is one of thousands of cryptocurrencies that have emerged in recent years. Launched in 2015 by eight co-founders, Ethereum operates on a decentralized network, known as a blockchain, which records and verifies transactions. The network itself is called Ethereum, while the currency unit is referred to as ether (e.g., 2 ether, 17 ether).

Ethereum’s blockchain functions like a ledger, continuously updating and confirming the history of every transaction on the network. Computers (or nodes) in the system verify these transactions, ensuring the data’s accuracy. This decentralized structure is part of Ethereum’s appeal, allowing users to transact without relying on a central authority, like a bank. The lack of intermediaries means transactions can occur with minimal fees, and anonymity can be maintained, even though all transactions are publicly recorded on the blockchain.

Although often referred to as currency, Ethereum is much more than that. It’s a platform that allows for decentralized applications (dApps) and smart contracts. Beyond using ether to send money or pay for goods, Ethereum enables a wide range of services, making it a versatile system in the cryptocurrency space.

How does Ethereum work?

Ethereum powers a variety of functions, including:

- Currency: Users can send and receive ether using a cryptocurrency wallet. Many platforms, like Coinbase, offer digital wallets for securely storing ether.

- Decentralized Apps (dApps): Ethereum hosts a wide range of digital applications, including games, financial services, and social media, all built on its blockchain.

- Smart Contracts: These self-executing contracts automatically complete transactions when specific conditions are met, eliminating the need for a middleman.

- Non-Fungible Tokens (NFTs): Ethereum powers NFTs, which allow artists and creators to sell digital goods directly to buyers through smart contracts.

- Decentralized Finance (DeFi): Ethereum enables users to engage in financial activities without relying on centralized institutions, allowing for peer-to-peer lending, borrowing, and more.

In this sense, it’s more accurate to think of ether as a token that powers Ethereum’s various applications, rather than merely as a currency.

How are ether coins created?

New ether is created when transactions are validated on the network through a process known as “proof of stake.” Ethereum switched to this method in September 2022 with a system update called The Merge. Under proof of stake, coin holders (known as validators) confirm transactions and are rewarded with new ether for their participation. However, validators can also lose ether if they approve fraudulent transactions or manipulate the system.

Before The Merge, Ethereum used a “proof of work” process, similar to Bitcoin, in which powerful computers solved complex mathematical problems to earn ether. Proof of stake is more energy-efficient and allows for faster transactions.

As of May 2024, there were about 120.1 million ether in circulation. This contrasts with Bitcoin, which has a maximum cap of 21 million coins, and Dogecoin, which has no issuance limit.

Ethereum ETFs on the Horizon

In late May 2024, the U.S. Securities and Exchange Commission (SEC) gave preliminary approval for spot Ethereum exchange-traded funds (ETFs). These funds would track Ethereum’s price directly, allowing investors to gain exposure to its value through traditional financial markets, without having to hold the cryptocurrency itself. The move has sparked excitement, as Ethereum ETFs are expected to lead to broader adoption and potentially higher demand for the crypto.

Is Ethereum a Good Investment?

Ethereum has seen dramatic growth in recent years, rewarding early investors with significant returns. However, potential investors should understand that Ethereum, like other cryptocurrencies, is not backed by any tangible assets or cash flow. Its value is driven purely by the belief that others will pay more for it in the future—a concept known as the “greater fool theory.”

This speculative nature makes Ethereum a high-risk investment. Prominent investors like Warren Buffett have criticized cryptocurrencies, with Buffett famously calling them “rat poison squared.”

Should You Buy or Stake Ethereum?

If you’re interested in Ethereum, you can easily buy it on platforms like Robinhood or Binance.US. These platforms offer round-the-clock access to the market, allowing for flexible trading. If you’re more interested in earning rewards through staking, you can either become a solo validator (which requires technical knowledge and significant investment) or join a staking pool.

Bottom Line

While speculating on Ethereum or other cryptocurrencies can be profitable, it’s essential to understand the risks involved. Cryptocurrency markets are notoriously volatile, and investors could lose their entire investment. As with any speculative asset, it’s crucial to invest only what you can afford to lose.